Best of the

Best

Editors' picks and our top buying guides

Best of the

Best

Editors' picks and our top buying guides

Latest

Best Mattress to Buy on Amazon in 2024

35 minutes ago30-Year Fixed Refinance Rates Surge: Mortgage Refinance Rates on April 17, 2024

36 minutes agoBest Savings Rates Today -- Snag an APY as High as 5.55% While You Still Can, April 17, 2024

1 hour agoBest Internet Providers in Centennial, Colorado

1 hour agoBest CD Rates Today -- Last Call for High APYs? April 17, 2024

1 hour agoSave Big With Woot's Refurbished iPhone and Apple Watch Sale While You Can

1 hour agoWhat to Know About 'Sexual Enhancement' Pills and Boosting Testosterone Levels

1 hour ago5 Tried-and-True Hacks to Calm Your Anxiety at Night

1 hour agoGet 80% Off This Harman Kardon Citation MultiBeam 700 Soundbar Before It's Gone

1 hour ago17 Best Food and Drink Subscription Gifts for Someone Special

1 hour agoTaylor Swift's 'The Tortured Poets Department' Album: A Streaming Guide for Fans

1 hour agoAct Now to Nab the Jackery Explorer 1000 for Only $849

1 hour agoSave 95% on Matt's Flights Premium Lifetime Subscription

1 hour agoGo Green Without Going Broke: 9 Eco-Friendly Hacks That Also Save Me Money

2 hours agoEnhanced Streaming: How to Set Up a VPN on Your Smart TV in Minutes

2 hours agoMore to Explore

Reviews, advice and more from CNET's experts.

Get the best price on everything CNET Shopping helps you get the best prices on your favorite products. Get promo codes and discounts with a single click.

Add to Chrome - it's free!

Our Expertise

Expertise Lindsey Turrentine is executive vice president for content and audience. She has helped shape digital media since digital media was born.

0357911176

02468104

024681024

Featured in

Tech

Upgrade your inbox

Get CNET Insider

From talking fridges to iPhones, our experts are here to help make the world a little less complicated.

Featured in

Money

Crossing the Broadband Divide

Millions of Americans lack access to high-speed internet. Here's how to fix that.

Featured in

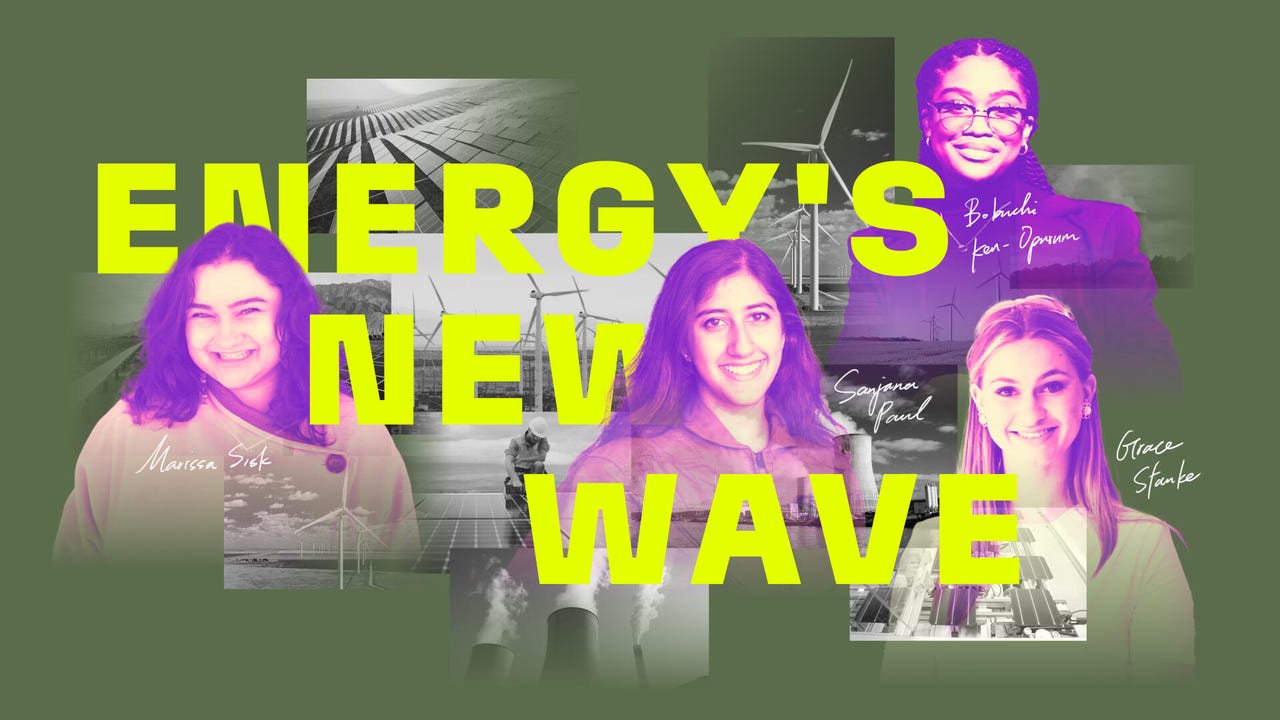

Energy and Utilities

Deep Dives

Immerse yourself in our in-depth stories.

Get the best price on everything CNET Shopping helps you get the best prices on your favorite products. Get promo codes and discounts with a single click.

Add to Chrome - it's free!

Featured in

Internet

Sleep Through the Night

Get the best sleep of your life with our expert tips.

Get the best price on everything CNET Shopping helps you get the best prices on your favorite products. Get promo codes and discounts with a single click.

Add to Chrome - it's free!

Tech Tips

Get the most out of your phone with this expert advice.

Get the best price on everything CNET Shopping helps you get the best prices on your favorite products. Get promo codes and discounts with a single click.

Add to Chrome - it's free!

Featured in

Home

Living Off Grid

CNET's Eric Mack has lived off the grid for over three years. Here's what he learned.